Congress strikes two-year budget deal: takeaways for healthcare leaders and benefits brokers

Posted: February 12, 2018 Filed under: Uncategorized Leave a commentCongress unveiled a two-year budget agreement Friday that would boost federal spending for several health programs.

Here are a few to know about in the budget agreement.

CHIP to be funded for a decade

The budget deal includes an additional four-year extension of the Children’s Health Insurance Program. That extension is on top of the six years of CHIP funding Congress approved in late January.

Funding for community health centers

The plan includes more than $7 billion in funding over two years for the nation’s community health centers. Federal funding for community health centers, which serve more than 27 million people, expired Sept. 30.

Relief for Disproportionate Share Hospitals

The spending deal would delay payment cuts to Disproportionate Share Hospitals mandated by the ACA, which have been pushed back since 2010. Disproportionate Share Hospitals serve a significantly disproportionate number of low-income patients and receive payments from the Centers for Medicaid and Medicare Services to cover the costs of providing care to uninsured patients.

Additional Funding for NIH and NHSC

The budget deal includes $2 billion in additional funding for the National Institutes of Health and $495 million for the National Health Service Corps.

Repeal of the IPAB

The budget deal would repeal the ACA’s Independent Payment Advisory Board, which was intended to hold down Medicare payments if the program’s spending exceeded a certain threshold. Members have never been appointed to the IPAB.

Cut prescription drug costs for seniors

The bill accelerates changes made in the Affordable Care Act to reduce the amount of out-of-pocket costs a senior has to pay for drug coverage. The so-called “doughnut hole” in Medicare’s drug benefit will be eliminated one year earlier than it would have been under the ACA.

Higher Medicare premiums for wealthy

Seniors with incomes of more than $500,000 a year (or $750,000 for a couple) will have to pay a greater share of their Medicare bills. Those highest income earners will owe 85% of program costs, instead of 80% under current law. Most Medicare beneficiaries pay 25%.

Cash for mental health and opioid crisis

Many health initiatives will get a boost, including $6 billion targeted to fight the opioid epidemic and fund mental health initiatives. The legislation extends the government’s major health insurance program for lower-income children an additional four years beyond a six-year renewal Congress recently approved. The bill also increases funding for community health centers, which serve lower-income patients. It delays Medicaid cuts to hospitals that serve large shares of poor people, adds funds to repair and rebuild veterans’ health clinics, and boosts funding for medical research.

Regarding the proposed merger between CVS Health and Aetna

Posted: December 4, 2017 Filed under: Uncategorized Leave a commentReflection from An Independent Physician’s Standpoint

i.e., Through the lens of your IPA Manager…

There are many moving parts to this important transaction between CVS Health and Aetna. It is a big Wall Street deal. And, it is very important to the business of the physician and clinician members of PDA. It will also be important to the patients of our nation. Even the national economy will be impacted.

The macro result is achievement of a new level of major healthcare integration and consolidation. The combined market clout puts Aetna more in a position like UnitedHealthcare in its ability to leverage an integrated Pharmacy Benefit Manager service in negotiating prices and establishing preferred tiers of employee benefits with manufacturers.

Rita Numerof, PhD, president of Numerof & Associates, said in an emailed statement to Becker’s Hospital Review, “With CVS’s large and growing clinical services footprint, Aetna can steer patients to CVS pharmacies and clinics — in many cases avoiding the costs of higher emergency room or other outpatient services. The merger can make expanded CVS services in-network and others out-of-network, putting additional pressure on conventional health systems to competitively lower the costs of their outpatient services.”

It seems that a major strategic position is how this will affect the Aetna positions regarding national network interest and support of physician-controlled IPAs versus physician and clinician groups owned by facility-based entities. These answers remain to be seen.

The traditional posture of physicians has been to endeavor to participate in all accessible managed care contracts with a focus on securing the “best available” reimbursement. That may well be changing. It is not unlikely that a practitioner is soon to be more concerned about securing network participation and a seat at the proverbial value-based compensation table.

PDA is intensely working to break out the desired future roles and opportunities for its members.

The facts as we know them….

CVS Health inked a definitive merger agreement to acquire all outstanding shares of Aetna for roughly $69 billion in cash and stock. It values Aetna at about $207 per share, higher than previous estimates of $200 to $205 per share. When including the assumption of Aetna’s debt, the transaction totals $77 billion.

Upon closing, Aetna’s Chairman and CEO Mark Bertolini will join CVS Health’s board of directors, along with two other Aetna leaders. Aetna will operate as a stand-alone business unit under the CVS Health umbrella, and the insurer’s management team will helm the subsidiary.

The companies said the deal will provide localized, community-based care across CVS Health’s 9,700-plus pharmacies and 1,100 clinics. Sources familiar with the deal told Reuters that CVS Health plans to significantly extend health services at its pharmacies under the merger.

The transaction is slated to close in the second half of 2018. It is subject to regulatory approvals.

More to come….

The New Medical School of Fort Worth

Posted: September 27, 2017 Filed under: Uncategorized Leave a comment

TCU and UNTHSC School of Medicine

Texas Christian University (TCU) and University North Texas Health Science Center (UNTHSC) have entered into a memorandum of understanding to create a new MD school in Fort Worth. The school will pioneer an education model for the practice and business of medicine that emphasizes teamwork and is centered on the patient.

Quick Facts & Next Steps

Below is a summary of the initiative along with initial steps that must occur:

- The MD school will be an equal collaboration and MD students will be considered students of both TCU and UNT Health Science Center.

- A steering committee comprising TCU and UNTHSC representatives will oversee plans regarding the development of the new MD school.

- A medical school management committee appointed by the TCU Chancellor and the UNTHSC President will manage the school. A dean will be jointly hired and report to the provosts of both institutions.

- Classes will be taught at TCU and at UNTHSC.

- Start-up costs will come from private philanthropic commitments for an MD school. Building infrastructure will not be necessary due to existing classroom, research and administrative space on the UNTHSC campus.

- The TCU Board of Trustees and the UNT System Board of Regents must approve the plans developed by the Medical School Management Committee.

- Plans call for the first class to consist of 60 students with applications beginning in fall 2017 and a target opening of fall 2018, pending SACSCOC approval. An estimated total MD enrollment of 240 students is planned by the academic year 2021-22.

- The MD school will be managed, branded and supported jointly by both institutions. While the school’s initial name will include both TCU and UNTHSC, the degrees awarded will not contain the name of the UNTHSC until such time as state law permits.

- The MD school is expected to provide more physicians for our community, and they will be educated via a team approach to the delivery of health care, which improves patient success and health while reducing medical errors and cost.

- Public and privately funded research investment is expected to increase after the MD school is operational.

Deadline approaches for Medicare Quality Payment Program Participants

Posted: September 21, 2017 Filed under: Uncategorized | Tags: MACRA, Medicare Leave a commentPUBLISHED BY PHYSICIANS DIRECT ACCESS, INC. FOR INFORMATIONAL PURPOSES ONLY.

PUBLISHED BY PHYSICIANS DIRECT ACCESS, INC. FOR INFORMATIONAL PURPOSES ONLY.

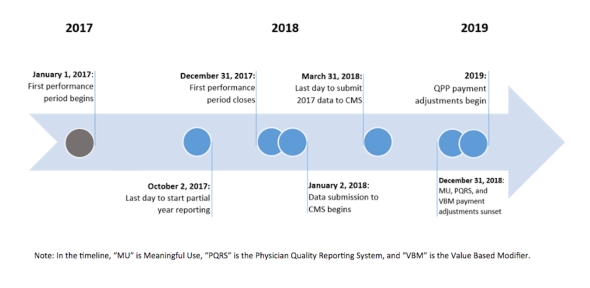

Avoid the negative 4-percent payment adjustment, last day to start partial year reporting is October 2, 2017

On January 1, 2017, known as the transition year, the Centers for Medicare & Medicaid Services (CMS) began the Quality Payment Program, established under the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA). According to CMS, the Quality Payment Program will reform Medicare Part B payments for clinicians billing more than $30,000 a year and providing care for more than 100 Medicare patients a year. However, there are some exceptions and not all clinician types are included. Clinicians can check their participation status by visiting the Quality Payment Program website at http://www.qpp.cms.gov and entering their individual NPI.

The Quality Payment Program has the following tracks from which clinicians can choose, based on their practice size, specialty, location, or patient population:

- The Merit-based Incentive Payment System (MIPS), or

- Advanced Alternative Payment Models (APMs)

The following links provide more information about the Quality Payment Program:

- Key Upcoming Dates for the Quality Payment Program

- A Quick Start Guide to the Merit-based Incentive Payment System (MIPS)

- Performance in Year 2017 Affecting Payment in 2019 Medicare Shared Savings Program and Quality Payment Program

- Key Upcoming Dates for the Quality Payment Program

Why are Managed Care Leaders Interested in Street Medicine?

Posted: August 2, 2017 Filed under: Uncategorized Leave a commentMonday’s Wall Street Journal published a piece on “street medicine”, featuring Dr. Jim Withers, a 2015 CNN Top 10 Hero and Founder of Operation Safety Net and the International Street Medicine Institute. Dr. Withers is confirmed to deliver the opening keynote address at the Inaugural Payer and Provider Summit on Social Determinants of Health for Complex Populations, September 11-12, Arlington, VA.

In 1992, Dr. Withers, an internal medicine physician, began providing medical care to Pittsburgh’s unsheltered homeless population. He partnered with street-savvy formerly homeless individuals and, initially dressing as a homeless person, began to make nighttime rounds in the alleys and under the bridges of the city. From this initial outreach service other clinical volunteers joined in and Operation Safety Net was born. Today, Operation Safety Net is recognized as one of the nation’s first targeted, full-time street medicine programs. It continues to set the standard for this unique form of health care.

Street medicine has become a global movement. Since 1993, a network of over 100 communities practicing street medicine has emerged globally. These practitioners are largely “homeless” themselves in the medical community. Not only is the practice unrecognized, but also the values they hold that prioritize the value of the most vulnerable are also not embraced by mainstream health care.

This is an interesting and intriguing development, but what makes it really an attention magnet is the published list of the first 100 seminar ticket buyers. PDA checked on who had committed to attend. Interestingly, Managed Care representation is in the first row and is in full attendance. That is quite thought provoking.

It is particularly interesting to PDA as the universal healthcare movement is all around the independent practitioner. From discussion of the single payer hybrids to concierge services, PDA continues to attempt to understand the currents of change and the howling winds of health care disparities. The daunting issues of medical cost, access issues, and ever-present chronic disease are everywhere.

(Thanks to Pittsburgh Mercy Health System)

Invitation To A Focus Group

Posted: July 11, 2017 Filed under: Uncategorized Leave a commentPhysicians Direct Access, the independent physician’s IPA, invites you to a unique focus group. Most medical practice surveys tend to assume that every physician has a clear idea of how they feel. Maybe so… Maybe not.

Focus groups can help in clarification and gaining real understanding of final-form thoughts and opinions. This is different from a generic survey focused solely on collecting data. A small, well-managed focus group has the capacity to develop an understanding of things at a deeper level. When well executed, focus groups create an environment that puts participants at ease, allowing them to freely answer questions and come up with suggestions.

You are invited to participate in a small group setting, exploring the relationship of a billing service to an IPA. This topic is a major impact on the future of independent physicians and clinicians.

If you wish to participate, please enlist below and the IPA will let you know about the time, place, and such. The entire process will be less than an hour and a half.

Signature: ___________________________________________________________________________

Return to PDA, 2665 Villa Creek Drive, Suite 205, Dallas, Texas 75234

Craig Greenway & SFMG

Posted: April 17, 2017 Filed under: Uncategorized Leave a commentThe PDA/IPA Difference

Healthcare today is full of uncertainty. The healthcare delivery and financing space is on the cusp of major change. Uncertainty can bring doubts about the future. As we all know, business planning and practice management are more important now than ever to help reduce those doubts. Also important, but maybe less in-focus than practice management, is the task of managing personal finances. Without effective planning, personal finances can certainly cause doubts and anxiety about the future as well.

With this in mind, your Management Services Organization (MSO) is endlessly seeking avenues to add support for our physicians, nurse practitioners, physician assistants, chiropractic doctors, and various allied health providers. This is a PDA difference. We review, study, challenge, and when justified, push new resources out to you for consideration.

Today, we would like to introduce you to Craig Greenway, CPA, CFP, Managing Director of SFMG Wealth Advisors (SFMG). We met Craig several years ago through a civic board relationship serving the Metrocrest Hospital Authority (MHA). He is the current President of the board and has always shown an intense interest in the financing and delivery of care in our community. He is a knowledgeable wealth management executive and, through MHA, is very familiar with healthcare issues.

We place great value in Craig’s leadership. We have come to appreciate and understand how he and SFMG help their clients through the wealth management process. While PDA works hard to provide managed care solutions, Craig and his team can help you plan your personal financial future. And as we all know, financial confidence in these changing times is invaluable.

To learn more see www.sfmg.com.

Changes in 2017: PODS

Posted: March 9, 2017 Filed under: Uncategorized Leave a commentGetting past the fact that Congress has vowed to make significant changes to Obamacare, transitions in healthcare in 2017 are already having an impact on long-term strategic decisions.

We need to accept that Medicare Access & CHIP Reauthorization Act (MACRA) is going to happen in ways that redefine the parameters of the Medicare Quality Payment Program, i.e., the long-planned move to value-based performance. MACRA reporting requirements began on January 1st, so the program is operational and the option to do nothing has passed.

The end result of this development is the reality of medical delivery accepting the advent of “risk reward”. It is now time to understand both the upside payment gains and downside penalty impacts. The Management Service Organization (MSO) serving Physician Direct Access (PDA/IPA) anticipates this change, not in a pro or con manner, but as a reality-based opportunity.

Our management has worked in this environment of performance “wins” for years; the option to pursue otherwise is unacceptable. The opportunity at-hand will thrive with hard deployment of modern population management and technology while providing high-quality patient care at an efficient cost.

This is a major shift from the somewhat unpredictable changes of managed care and the limitations of a messenger-model IPA. This blog has addressed a future of “risk-reward” contracting for several years. We have both recollections and first-hand knowledge of how physician organized delivery systems (PODS) can work. We have gloried in the PODS’ ability to save the patient hassle and cost while paying the practitioner based on results. Now the market and government changes are supportive to “risk-reward” initiatives.

The plan is to select practitioners (Specialists & PCPs, mid-level providers, allied health practitioners, Chiropractic Physicians, etc.) who are candidates for engaging in a physician organized delivery system. That is the goal. The MSO is at work to build IPA capability and inter-disciplinary collaboration with every possible avenue of IPA member participation.

Much more to follow…

After The Blocked Aetna-Humana Merger…

Posted: February 4, 2017 Filed under: Uncategorized Leave a commentThis is a message for clinical colleagues, office managers, and PDA’s working teammates. Insurers can only scale so much to drive efficiency and profits. Saying it again…“Going forward, both industry consolidation and the changes relating to the Affordable Healthcare Act, will not be a panacea for growing insurer profit margins.” Eight years of a dramatic federal redo of the healthcare insurance model is perhaps in the rearview mirror. And, the view of the road before us is somewhat unclear. Still, leading insurance executives must continue to look for other ways to increase returns. Achieving return on investment is inescapable.

This message underscores that IPAs must perform the credentialing, verification, and contracting support functions with a higher level of efficiency. Also, communication with the carriers and providers must be constantly improved and reviewed for quality control. PDA and our peer group need to improve our performance ASAP. This means the IPA has to be engaged with the membership while continuing to serve as an administrative resource. We must aggressively assert the rights for the independent providers. And, we have to determine new avenues of provider income enhancement.

We are going to grow closer in synergy with the carriers and partial self-funded plans. Our physician members will be called on to assist in enhancing the carrier and business-owner relationships. Our primary care group has an important role in interacting with businesses, law firms, engineering firms, etc. Throughout this year, we will work to effectively communicate to professionals and patients the added value of independent providers who care about performance and value. This has exciting, practical potential.

This retooling of the essentials means an increased emphasis on vertical integration with the preferred carriers and business community—that is, supporting more involvement by payers at the provider and patient level to more effectively manage risk. We are headed into the risk-reward area of providing service. We are actively evaluating third-party ACO systems to jump start risk-reward contracting.

The size of a provider group is not the key in value-added service. It is how good are we in managing performance metrics, intergroup financial equity, and patient satisfaction.

More to come….

House Republicans have unveiled a plan to repeal and replace the Affordable Care Act

Posted: December 21, 2016 Filed under: Uncategorized Leave a commentThe plan—detailed in a document called “A Better Way”—says that “Obamacare must be fully repealed so we can start over and take a new approach.” To replace the president’s signature healthcare law, the plan weaves together a variety of healthcare policy ideas in its outline of what should replace the ACA. A copy of the plan may be requested from your PDA office, or downloaded here.

Here’s a breakdown of some of the plan’s key provision:

A new approach to exchanges. The Republicans’ plan would offer everyone who doesn’t qualify for employer coverage, Medicare or Medicaid to access a refundable tax credit to use in the individual market—instead of the ACA’s current policy of offering tax credits to just those of certain incomes. The credit is also age-adjusted, the report says.

“Association health plans,” in which small business and groups such as alumni organizations and trade associations band together to offer healthcare coverage at better rates via improved bargaining power with insurers. This would “free employers from costly state-mandated benefit packages and lower their overhead costs,” the document says.

Robust high-risk insurance pools. The plan would set aside at least $25 billion to fund programs that Republicans say would give financial support for those with high medical costs who find themselves priced out of coverage. Premiums for those participating in the high-risk pool would be capped, and wait lists would be prohibited, according to the document.

A one-time open enrollment period for the uninsured, regardless of health status. If consumers who lack coverage don’t enroll in a plan during that open enrollment period, they forfeit continuous coverage protections and could face higher insurance costs in the future.

The sale of insurance across state lines. This often-cited GOP policy proposal, according to the document, will make the insurance market more competitive and give consumers the ability to access the most affordable policies.

The preservation of certain ACA protections. The plan would prevent those with pre-existing conditions from being denied coverage, as well as allow individuals to stay on their parents’ insurance plan until age 26.

Medicaid reforms that would allow states to choose between either a per capita allotment for their programs or a block grant. States would be allowed the flexibility “to charge reasonable enforceable premiums” or offer a limited benefit package. The proposal also takes several steps to “modernize” the Medicaid demonstration waiver process, requiring them to be budget neutral while grandfathering in some successful waiver provisions.

The document, however, lacks details about how the plan would be financed. That’s because it is mainly a “framework” upon which congressional committees will build next year.

Sources: Kaiser Health News, Fierce Healthcare IT